Opareta is a mobile app that helps mobile money agents digitize their operations. With Opareta, agents can benefit from faster transactions, comprehensive digital records, smart business reports, and affordable working capital loans.

Opareta Limited

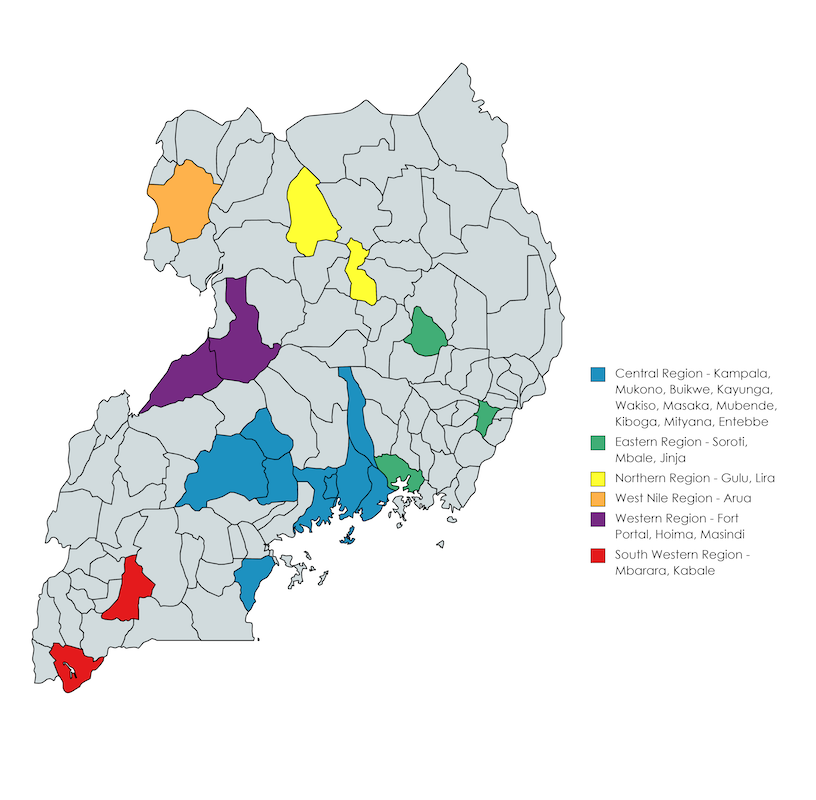

We operate in a number of cities and towns in Uganda. Refer to the map below for details.

Any mobile money agent that meets the below criteria:

Please note that although any agent who meets the above criteria can use the app, Opareta will only lend to those located in areas where Opareta has a field team presence.

To download the Opareta app, please click on this link or go to Google Play Store and search for Opareta.

To create an account with Opareta, you need to first download the app and fill in your data to complete the registration process. The requirements for installing Opareta are:

You are eligible for a loan after the following:

Agents initially qualify for a loan of up to UGX 250,000 for a period of 1 week. Agents can then access better loan terms (bigger sizes, longer tenors, and lower prices) as they demonstrate good repayment behavior.

Agents who complete all their loan payments can qualify for a next loan (standard terms and conditions apply). Based on their previous repayment behavior, they will fall within one of the following buckets:

| Loan Number | Loan Amount (UGX) | Loan Period (Weeks) |

|---|---|---|

| 1 | 250,000 | 1 |

| 2 | 500,000 | 2 |

| 3 | 750,000 | 3 |

| 4 | 1,000,000 | 4 |

After the fourth loan, the agent can access loans in increments of up to UGX 1,000,000. The maximum loan amount the agent can borrow is UGX 3,000,000 for a maximum period of 8 weeks.

You need to share all KYC documents requested when registering on the app. These documents include:

Payments can be made by direct float transfer to the following mobile money agent account:

If you are unable to pay in-app, payments can be made by direct float transfer to the following mobile money agent account:

When the payment is late, the loan is listed as delinquent. This will impact your ability to qualify for the next loan. Opareta field agents will contact you to follow up on the payments and advise on the best way forward depending on your situation.

Opareta uses your KYC and transaction data to determine your eligibility for a loan.

Opareta needs permissioned access to Messages, USSD, Media, and Location in order to enable transaction functionality and represent transaction activity in the digital ledger and reports. Please note that Opareta cannot access your agent wallet. The app only records the cash inflows and outflows on the SIM card, rather than engaging with the wallet itself.